港中文精算本科精算核心课程各科目大纲详细介绍。

前段时间 Jackie 找香港中文大学(Chinese University of Hong Kong,简称CUHK)商学院精算本科(BBA in Insurance, Financial and Actuarial Analysis)的同学要了一份课件进行学习,作为对自身精算知识点的补充。今天就和大家介绍一下港中文精算本科的课程体系。另外,2022年秋季开始,港中文商学院新开设了精算科学与保险分析硕士(MSc in Actuarial Science and Insurance Analytics),同个学校的精算本科和精算硕士的课程内容大概率一致,所以港中文精算本科和硕士的同学都可以参考本文内容安排学习。

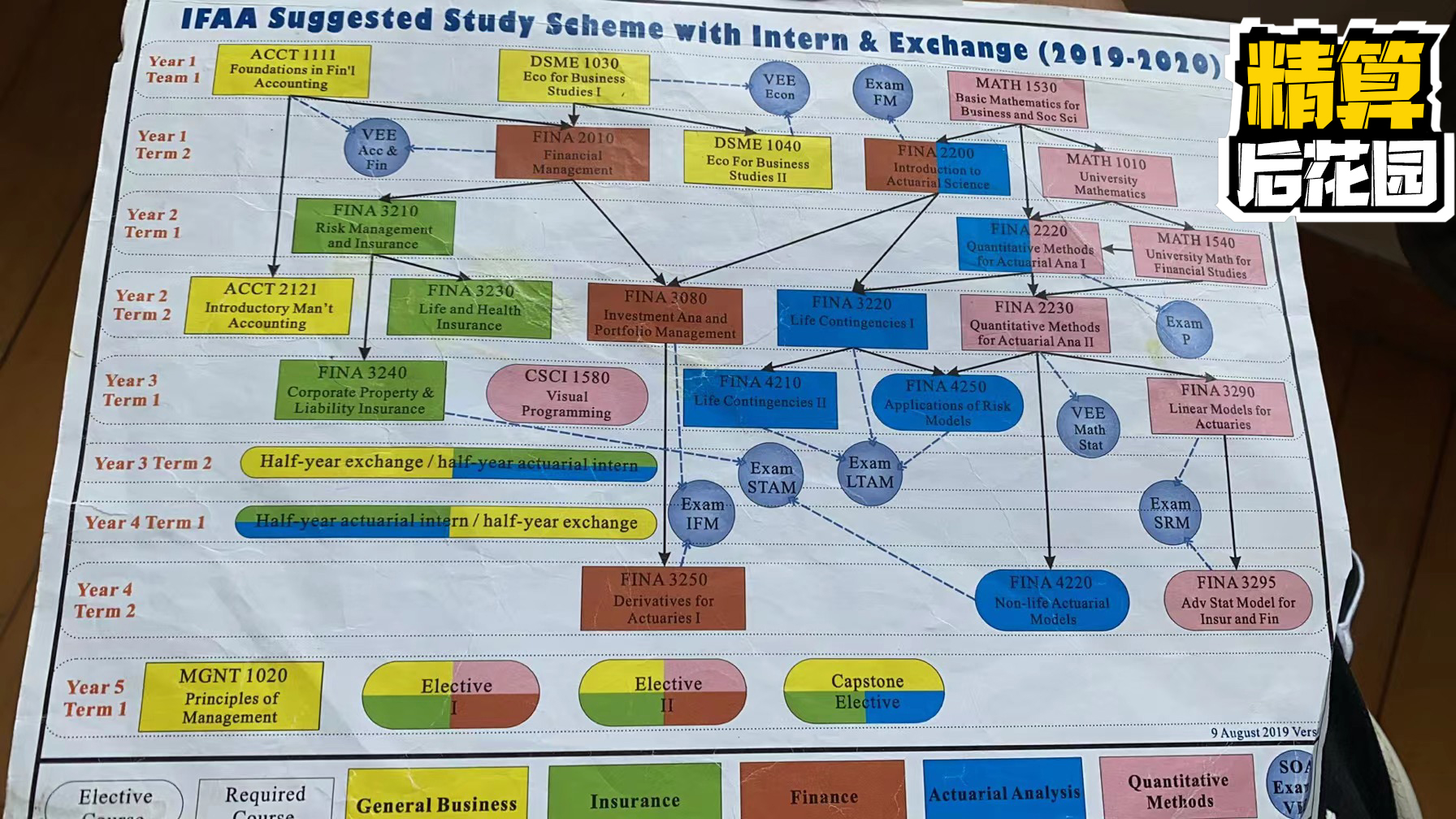

港中文精算本科全部课程

港中文精算本科阶段的所有课程(精算核心课程和非精算课程)逻辑关系图如下:

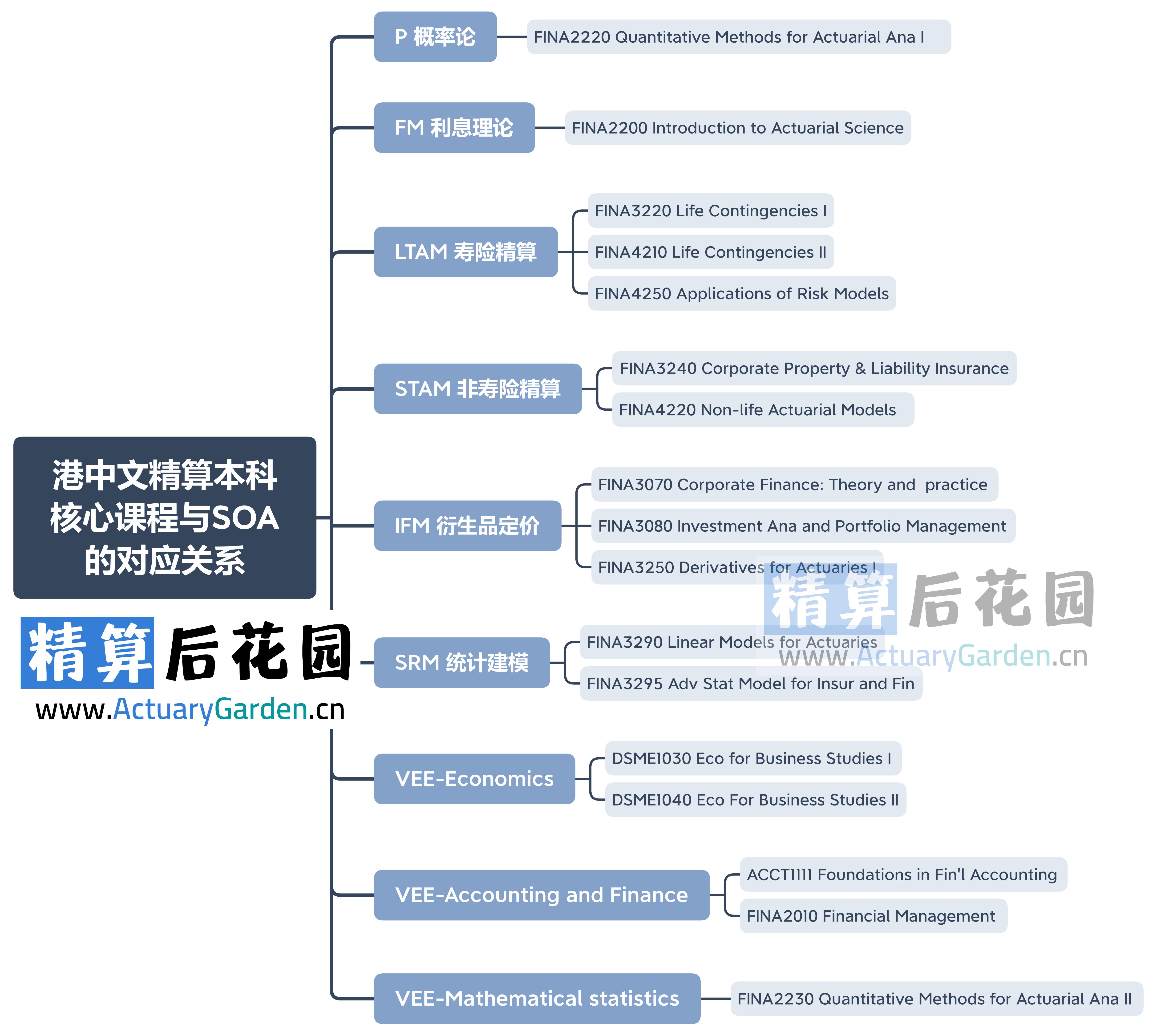

港中文精算本科精算核心课程

其中,港中文精算本科中与精算直接相关的核心课程为:

- FINA2220 Quantitative Methods for Actuarial Ana I

- FINA2200 Introduction to Actuarial Science

- FINA3220 Life Contingencies I

- FINA4210 Life Contingencies II

- FINA4250 Applications of Risk Models

- FINA3240 Corporate Property and Liability Insurance

- FINA4220 Non-life Actuarial Models

- FINA3070 Corporate Finance: Theory and Practice

- FINA3080 Investment Ana and Portfolio Management

- FINA3250 Derivatives for Actuaries I

- FINA3290 Linear Models for Actuaries

- FINA3295 Adv Stat Model for Insur and Fin

- DSME1030 Eco for Business Studies I

- DSME1040 Eco For Business Studies II

- ACCT1111 Foundations in Fin'l Accounting

- FINA2010 Financial Management

- FINA2230 Quantitative Methods for Actuarial Ana II

- FINA3210 Risk Management and Insurance

- FINA3230 Life and Health Insurance

港中文的核心精算课程是按照北美精算师考试(SOA)内容设置的(港中文的精算项目现在已有CAE认证,似乎可以免考 SOA 的 SRM 科目),与 SOA 各科目对应关系如下图:

接下来按照上述顺序和大家分享一下各科目的课程大纲。

P 概率论

可以参考【P导引篇】Probability.

FINA2220 Quantitative Methods for Actuarial Ana I

精算分折之基礎計量方法(一):

Chapter 1 Combinatorial Analysis

- Basic principle of counting; permutations; combinations; multinomial coefficients.

Chapter 2 Axioms of Probability

- Sample space and events; axioms of probability; some simple propositions; sample spaces having equally likely outcomes;probability as a measure of belief.

Chapter 3 Conditional Probability and Independence

- Conditional probabilities; Bayes's formula; independent events; P(·|F) is a probability.

Chapter 4 Random Variables

- Discrete random variables; expected value; expectation of a function of a random variables; variance; Bernoulli, binomial, Poisson, negative binomial, geometric, and hypergeometric random variables; sums of random variables; cumulative distribution function.

Chapter 5 Continuous Random Variables

- Expectation and variance; uniform, normal, exponential, gamma, and weibull random variables; distribution of a function of a random variable.

Chapter 6 Joint Distributed Random Variables

- Joint distribution functions; independent random variables; sums of independent random variables; conditional distributions; order statistics; joint probability distribution of functions of random variables.

Chapter 7 Properties of Expectation

- Expectation of sums of random variables; covariance, variance of sums, and correlations; conditional expectation; probability and moment generating functions; additional properties of normal random variables

Chapter 8 Limit Theorems

- Chebyshev's inequality; weak law of large numbers; central limit theorem; strong law of large numbers; Jensen's inequality

FM 利息理论

可以参考【FM导引篇

】Financial Mathematics. 这部分内容 Jackie

在以往的辅导中已经备完课,需要一对一辅导的同学可以加我微信号

AGJackie .

FINA2200 Introduction to Actuarial Science

Chapter 1 Interest Accumulation and Time Value of Money

- Accumulation functions; simple and compound interest; frequency of compounding; effective rate of interest; Rates of discount, force of interest; future & present value of a single payment; equation of value

Chapter 2 Annuities

- Annuities due and immediate; perpetuity; deferred annuity; annuity values at other times; Annuities under other accumulation methods; annuities with varying interest rates; Continuous annuities; variable annuities; term of annuity and rate of interest

Chapter 3 Interest Rates

- Spot rates; forward rates and the term structure; Interest rate swaps

Chapter 4 Rates of Return

- Internal rate of return; One period rate of return; rate of return over multiple periods portfolio return

Chapter 5 Loans and Costs of Borrowing

- Outstanding loan balance; Amortization schedules; Sinking funds; varying instalments and varying interest rates; practical applications

Chapter 6-8 Bonds

- Bond evaluation; bond amortization schedules; bond Management

Chapter 9

- Determinants of interest rates

LTAM 寿险精算

可以参考【LTAM导引篇】Long-Term

Actuarial Mathematics和西浦MTH214和利物浦MTH373复习要点(寿险精算II).

港中文的这三科的内容主要对应的教材是 D. C. M. Dickson, M. H. Hardy and

H. R. Waters (2020). Actuarial Mathematics for Life Contingent Risks.

3rd Ed. Cambridge University Press. 这三科的内容 Jackie

在以往的辅导中已经备完课,需要一对一辅导的同学可以加我微信号

AGJackie .

FINA3220 Life Contingencies I

Chapter 1 Survival Models

- The future lifetime random variables; the force of mortality; actuarial notation; mean and standard deviation of future life time random variables; curtate future lifetime

Chapter 2 Life Tables and Selection

- Life tables; fractional age assumptions; national life tables; survival models for life insurance policyholders; life insurance underwriting; select and ultimate survival models; notation and formulae for select survival models; select life tables; comments on heterogeneity in mortality; mortality trends

Chapter 3 Life Insurance

- Assumptions; valuation of insurance benefits; relating actuarial present values for continuous and discrete cases; variable insurance benefits; functions for select lives

Chapter 4 Life Annuities

- Review of annuities-certain; life annuities payable with different payment frequencies; deferred annuities; guaranteed annuities; increasing annuities; evaluating annuity functions; numerical illustrations; functions for select lives

Chapter 5 Premium Calculation

- Assumptions; the present value of future loss random variable; the equivalence principle; gross premium; profit; the portfolio percentile premium principle; extra risks

Chapter X Net Level Premium Benefit Reserves

- 详细内容见 FINA4210 Life Contingencies II Chapter 6 Net Premium Reserve

FINA4210 Life Contingencies II

Chapter 6 Net Premium Reserve

- Prospective and recursive calculation, interim reserve, Thiele’s differential equation

Chapter 7 Insurance Models Including Expenses

- Gross premium reserve, expense reserve, modified reserve, profit and its decomposition

Chapter 8 Multiple Decrements: Theory

- Force of decrement, associated single decrement, fractional age assumptions

Chapter 9 Multiple Decrements: Applications

- EPV, reserve and profit calculations

Chapter 13 Deterministic Profit Testing

- Profit vector and profit signature, application in pricing and valuation

Chapter 12 Pension Plans

- Salary projection, DB plans, accrued and non-accrued benefits, service table, valuation and funding of plans

FINA4250 Applications of Risk Models

Chapter 11 Multiple Life Functions

- Insurance and annuities for joint and last survivor statuses, contingent life functions, dependent life models

Chapter 14 Survival Analysis

- Non-parametric estimation (KM and NA estimators), large sample approximation, interval-based approximation

Chapter 10 Multiple State Models

- Transition probability matrix and intensity, the Kolmogorov forward equations, pricing and valuation

Chapter 16 Health Benefits

- Health policies: features, modelling and pricing, continuing retirement caring community

Chapter 15 Mortality Improvement

- Mortality improvement scales, stochastic mortality models

STAM 非寿险精算

可以参考【STAM导引篇】Short-Term Actuarial Mathematics.

FINA3240 Corporate Property and Liability Insurance

- Chapter 1 Why Insurance?

- Chapter 2 Property and Casualty Coverages

- Chapter 3 Ratemaking

- Chapter 4 Loss Reserving

- Chapter 5 Intermediate Topics

FINA4220 Non-life Actuarial Models

非壽險精算模型:

Chapter 1 Practical Considerations in Parametric Estimation

- Maximum likelihood estimation for truncated and censored data, standard error and CI; Validation and Selection of Parametric Models (pp plot, KS test, likelihood ratio test, SBC and AIC)

Chapter 2 Fundamentals of Loss Models

- Introduction to aggregate loss model, creating severity distribution; The (a, b, 0) class, property of Poisson distribution; Thinning. computation of compound distribution, stop loss insurance

Chapter 3 Greatest Accuracy Credibility

- Hierarchical linear model, the Bühlmann model; The Bühlmann model: harder examples, estimation; the Bühlmann-Struab model

Chapter 4 Estimation of Credibility Factor

- Estimation in the Bühlmann-Struab model, semi-parametric estimation; Classical credibility and its failure

Chapter 5 Individual Policy Modifications

- Definition of limited expected value; Coverage modifications: deductible and bonus; Coverage modifications: limit, inflation; the (a, b, 1) class; Thinning of (a, b, 1), Panjer’s recursion, interaction of frequency and severity

IFM 衍生品定价

FINA3070 Corporate Finance: Theory and Practice

(课件暂缺,有该科目课件的同学请联系我)

FINA3080 Investment Ana and Portfolio Management

(课件暂缺,有该科目课件的同学请联系我)

FINA3250 Derivatives for Actuaries I

Chapter 1 Introductory Derivatives

- Underlying assets, Prepaid forward and forward contract, Currency forwards, Put-call parity, Option strategies, Path-dependent options, Futures contracts and their options

Chapter 2 The Binomial Tree Model

- Replicate derivatives in a single-period binomial tree; Multi-period tree; Pricing American options, volatility and tree construction; Pricing currency option using binomial tree; Limit of binomial tree

Chapter 3 The Black-Scholes Model

- The lognormal distribution; The Black-Scholes framework, Risk-neutral pricing, The Black-Scholes formula, Pricing currency options and options on discrete-dividend paying stock

Chapter 4 Greek Letters and Their Applications

- Greek letters: calculation; Greek letters: qualitative properties, elasticity, delta-gamma-theta app; Delta-hedging, rebalancing, Gamma-neutrality

Chapter 5 Exotic Options

- Asian, exchange and chooser options; Compound, forward start, lookback and shout options

Chapter 6 Options in Insurance

- Variable annuities; Other types of insurance guarantees; Risk management

Chapter 7 Further Topics on Options

- Price and convexity constraint for options; Option bounds; Effect of time to expiration; Exercising of American call; Decision trees and real options

Chapter 8 Investment Risk Measures

- Investment risk measures: Variance and semi-variance; Var and TVaR; Coherence

SRM 统计建模

FINA3290 Linear Models for Actuaries

Chapter 1 Exploratory Data Analysis

- Graphical tools; estimation and hypothesis testing; correlation analysis

Chapter 2 Simple Linear Regression

- Model assumptions; parameter estimation; statistical inference on parameters; predicted values, confidence and prediction intervals

Chapter 3 Multiple Linear Regression I

- Model assumptions; parameter estimation; statistical inference on parameters; predicted values, confidence and prediction intervals

Chapter 4 Multiple Linear Regression II

- Transformation of variables; interactions; qualitative independent variables

Chapter 5 Variable Selection and Diagnostic Checking

- Automatic variable selection procedures; residual analysis; influential points; collinearity; selection criteria; heteroscedasticity

Chapter 6 Categorical Dependent Variables

- Binary, nominal and ordinal dependent variables; logistic and probit regression models

Chapter 7 Count Dependent Variables

- Poisson regression; overdispersion and negative binomial models

Chapter 8 Generalized Linear Models

- GLM models; estimation; residual analysis; Tweedie Distribution

FINA3295 Adv Stat Model for Insur and Fin

Chapter 1 Modeling Trends

- Time series data; objectives of time series analysis deterministic and stochastic trend models; white noise process; stationarity

Chapter 2 Autocorrelation and Linear Time Series Models

- Autocorrelations; partial autocorrelations; sample moments; AR, MA, ARMA models; nonstationary time series; ARIMA models; variable stabilizing transformations

Chapter 3 Statistical Inference of Linear Time Series Models

- Forecasting; model identification; parameter estimation; diagnostic checking; Box-Jenkins approach; model selection; forecast evaluation; choice of sample period; seasonal ARIMA models

Chapter 4 Other Forecasting Methods and Time Series Models

- Smoothing with moving averages; exponential smoothing; unit root tests; ARCH and GARCH models

Chapter 5 Statistical Learning

- Prediction accuracy vs model interpretability; supervised vs unsupervised learning; regression vs classification problems; assessing model accuracy

Chapter 6 Resampling Methods and Linear Model Selection

- Cross-validation; subset selection

Chapter 7 Linear Model Regularization

- Ridge regression; the lasso; K-nearest neighbors; dimension reduction methods; high dimensional data

Chapter 8 Tree-based Methods

- Basics of decision trees; bagging, random forests; boosting

Chapter 9 Principal Components Analysis

- Principal components and their interpretation

Chapter 10 Clustering Analysis

- K-means clustering; hierarchical clustering, practical issues

VEE-Economics

DSME1030 Eco for Business Studies I

(课件暂缺,有该科目课件的同学请联系我)

DSME1040 Eco For Business Studies II

(课件暂缺,有该科目课件的同学请联系我)

VEE-Accounting and Finance

ACCT1111 Foundations in Fin'l Accounting

(课件暂缺,有该科目课件的同学请联系我)

FINA2010 Financial Management

(课件暂缺,有该科目课件的同学请联系我)

VEE-Mathematical statistics

FINA2230 Quantitative Methods for Actuarial Ana II

Chapter 8 Sampling Distribution

- Population and sample, random sampling, parameter and sample statistics; The Chi-Square Distribution, The t Distribution, The F Distribution

Chapter 9 Point Estimation

- Methods of moments, percentile matching, maximum likelihood estimation, properties of estimator including MSE, efficiency, UMVUE, consistency

Chapter 10 Interval Estimation

- Confidence interval, estimation of means, difference between means, variance, ratio of variances, proportions, and difference between proportions

Chapter 11 and 12 Statistical Inference

- Null and alternative hypothesis, significance, two types of error, power, p-value, NP lemma, UMPT, LRT, standard tests including mean and variance, mean difference and ratio of variance, tests for proportion including test for equality of proportion and contingency tables, one-way ANOVA, goodness-of-fit test, information criteria

Chapter 13 Bayesian Analysis

- Prior and posterior distribution, credibility interval, p-value under Bayesian test